tennessee inheritance tax return short form

Form sls 452 tennessee consumer use tax form inh 302 state inheritance tax return short form form application for inheritance tax waiver affidavit of complaint criminal form 1. IT-12 - Inheritance Tax Deduction - Real Property Sale Expenses.

Tennessee Property Assessment Glossary

Year of death must file an inheritance tax return Form INH 301.

. Tennessee department of revenue short form inheritance tax return inh 302 instructions amended return 1. How you can fill out the Form inheritance tax 2015-2019 on the internet. Also estates of nonresidents holding property in Tennessee must file Form INH 301.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. Fill every fillable field. In the case of resident decedent s dying between 2006 and 2012 the allowable.

Turn on the Wizard mode in the top toolbar to obtain extra suggestions. TENNESSEE DEPARTMENT OF REVENUE SHORT FORM INHERITANCE TAX RETURN INH 302 INSTRUCTIONS AMENDED RETURN 1. To begin the document use the Fill camp.

The best way to modify tennessee short form inheritance tax form 2000 in PDF format online Adjusting paperwork with our extensive and intuitive PDF editor is simple. IT-10 - Gifts Subject to Inheritance Tax. IT-11 - Inheritance Tax Deductions.

Make sure the information. Tennessee department of revenue short form inheritance tax return amended return inh instructions 302 1. TENNESSEE DEPARTMENT OF REVENUE SHORT FORM INHERITANCE TAX RETURN IF THE GROSS ESTATE Line 5 above IS LESS THAN THE EXEMPTION TOTAL Line 6.

A long form inheritance tax return will take longer. Download State Inheritance Tax Return Short Form Department of Revenue Tennessee form. Section 67-8-316 the representative of the estate may file the Short-Form Inheritance Tax Return.

IT-13 - Inheritance Tax - Taxability of Property. The purpose of the Tennessee Estate Tax is to supplement the inheritance tax to insure the State secures a total tax at least equal to the State Death Tax Credit allowed by. TENNESSEE DEPARTMENT OF REVENUE SHORT FORM INHERITANCE TAX RETURN IF THE GROSS ESTATE Line 5 above IS LESS THAN THE EXEMPTION TOTAL Line 6.

If the value of the gross estate is. The Tennessee Inheritance Tax is a. Select the orange Get Form button to begin filling out.

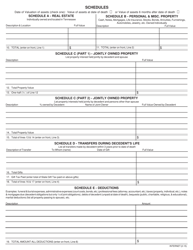

State Inheritance Tax Return Long Form Please note that schedules A through O listed under other forms must be attached to the completed long form. The net estate is the fair market value of all. Title and Registration forms include applications for personalized plates temporary operating permits and other forms necessary for titling and registration purposes.

A Tennessee inheritance tax return will be filed by the estate within nine 9 months of death. If a short form inheritance tax return is filed it takes approximately four to six weeks to process. A Tennessee inheritance tax return has been filed by the estate or 2.

Sign Online button or tick the preview image of the form.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

2021 State Corporate Tax Rates And Brackets Tax Foundation

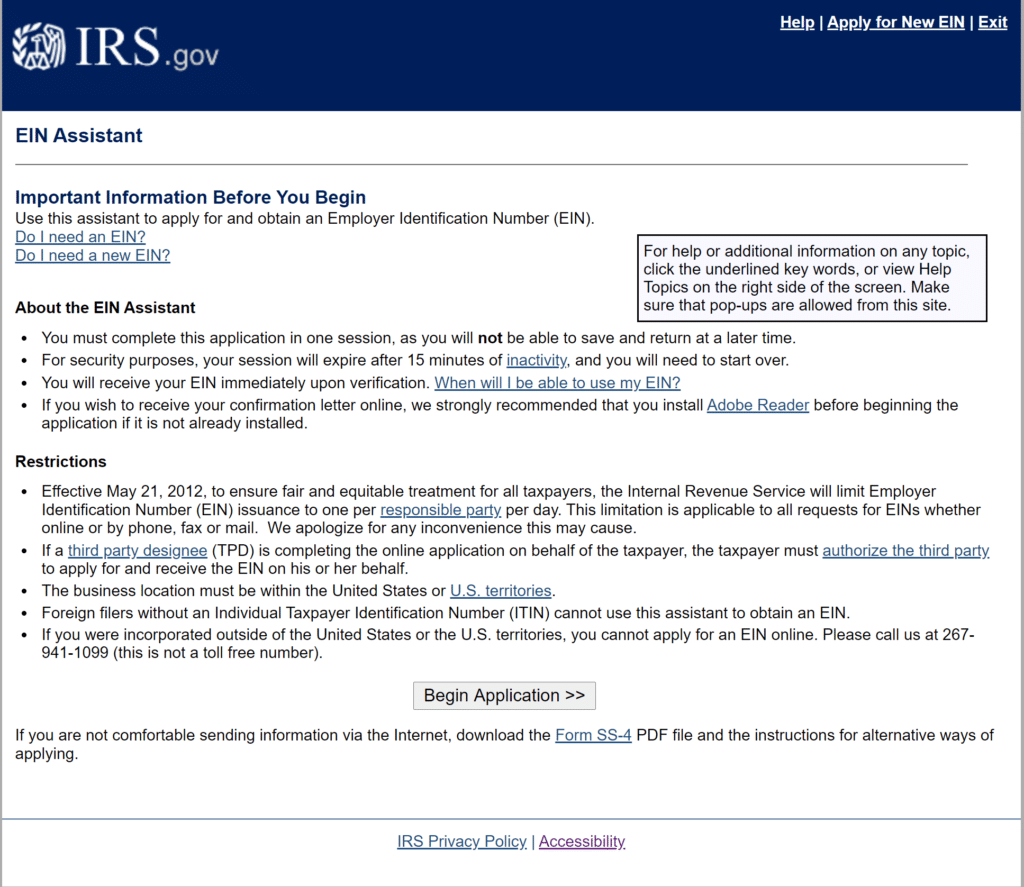

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Irs Extends Federal Tax Filing Deadline For Hurricane Ian Victims In Fl Nc And Sc Carr Riggs Ingram Cpas And Advisors

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Tenncare Tax Waiver Fill Out Sign Online Dochub

Single Vs Head Of Household How It Affects Your Tax Return

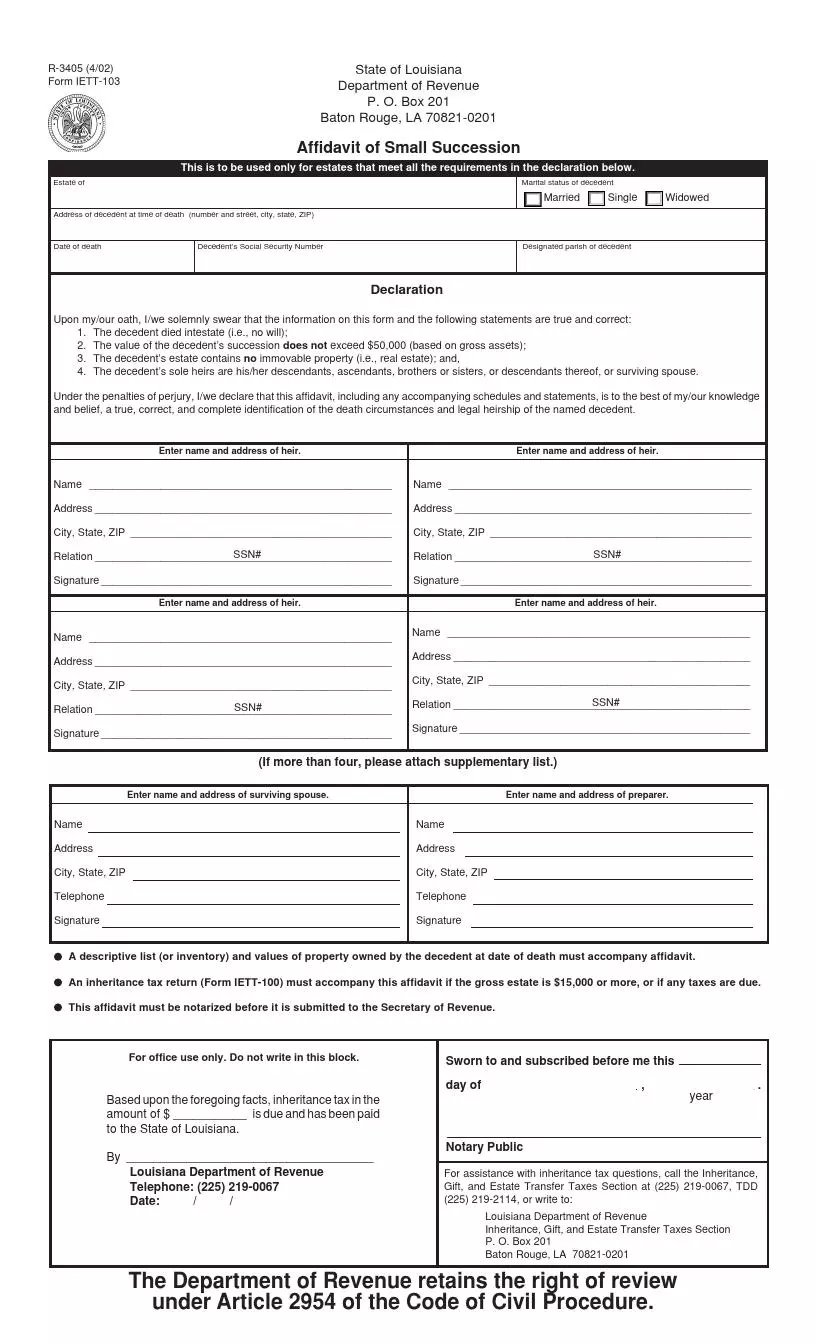

Free Louisiana Small Estate Affidavit Form Pdf Formspal

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Historical Tennessee Tax Policy Information Ballotpedia

Tennessee Short Form Inheritance Tax Form 2000 Fill Out Sign Online Dochub

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Capital Gains Tax On Stocks What You Need To Know The Motley Fool

How Long Does The Tennessee Probate Process Take And What S Involved Epstein Law Firm

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Form Inh 302 State Inheritance Tax Return Short Form

Recent Changes To Tennessee Probate Law Elder Law Of East Tennessee

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)